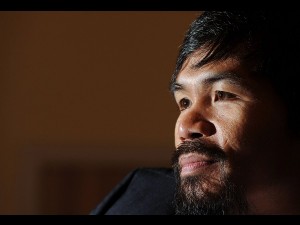

SAN FRANCISCO—The Internal Revenue Service is going after Filipino boxing superstar Manny Pacquiao with an $18 million alleged tax deficiency assessment from 2006 to 2010.

The IRS is asking Pacquiao, who made most of his boxing fortune fighting in the United States, to pay up $18,313,668.79 in tax debt over the five year period, according to a TMZ Sports exclusive report.

TMZ, the popular and gossipy U.S. TV show that delves in the lives and fortunes of celebrities, said it has obtained “official documents” that suggested Pacquiao owed federal income taxes as follows:

2006 — $1,160,324.30

2007 — $2,035,992.50

2008 — $2,862,437.11

2009 — $8,022,915.87

2010 — $4,231,999.01

12 big-ticket fights

Pacquiao, who started fighting in the U.S. in 2001, had 12 big-ticket fights, mostly in Las Vegas, for the years the IRS is said to be going after the boxing icon in back taxes.

Pacquiao, the former No. 1 boxer in the world pound-for-pound, first fought on U.S. soil on June 25, 2001 as a last minute replacement for an injured challenger, knocking out International Boxing Federation super bantamweight Lehlohonolo Ledwaba in the sixth round in Las Vegas.

Pacquiao, now a second-term congressman in the Philippines, fought a total of 25 times in America, winning five of eight record world titles in different world classes during a lucrative U.S. campaign that made him the richest Asian boxer in history.

Curiously, the year 2009 when he was assessed an alleged tax deficiency of $8,022,915.87 was the same year Pacquiao won world titles at light welterweight and welterweight in two of his biggest fights at the MGM Grand Arena in Las Vegas.

Pacquiao grossed an estimated $12 million from the Hatton fight and about $25 million from the Cotto fight.

On May 2, 2009, Pacquiao scored a stunning second round knockout to snatch British world champion Ricky Hatton’s 140-pound title. Six months later, on Nov. 14, Pacquiao stopped Miguel Cotto in the 12th round to annex the Puerto Rican’s World Boxing Organization welterweight title.

Disallowed deductions

In Manila, however, Pacquiao’s financial adviser Michael Koncz told Rappler.com that the $18 million being sought by the IRS is for the deductions disallowed by the tax agency.

“This is now being handled by our lawyers in America. This is not something new that happened yesterday. We have been discussing this issue with the IRS during the last 3 years,” Koncz was quoted by a Manila-based newswebsite.

Koncz did not specify which expenses they included in Pacquiao’s U.S. tax returns were disallowed by the IRS.

Koncz admitted that there may be some that will be disallowed but not as high as $18 million.

Manila tax consultant Honorata Gamayo explained that disallowed deductions refers to expenses being claimed by a taxpayer which the taxman disapproved and is therefore subject to taxes.

“Even assuming that $18 million in deductions were disallowed by the IRS, it does not follow that Manny owes the IRS that much,” Gamayo explained by phone.

“It simply means that the disallowed amount would have to be subject to the applicable tax rate, which definitely will be much lower than the figures quoted in the news,” she added.

Problems with BIR

The Pinoy boxing hero’s U.S. tax woes come on the heels of his highly publicized tax problems with the Philippines’ Bureau of Internal Revenue which recently froze P1.1 billion in known Pacquiao’s bank accounts and garnished some of his assets, including his house at the exclusive Forbes Park at the heart of the country’s financial district in Makati.

The BIR, the Philippines’ IRS, slapped Pacquiao with a P2.2 billion ($50.2 million) tax deficiency for 2008 and 2009, which is now awaiting adjudication by the Court of Tax Appeal.

RELATED STORIES:

Pacquiao shows IRS document on taxes paid in 2008, 2009

BIR explains why Pacquiao’s tax liability reached P2.2B

Pacquiao leaves talking on tax issue to lawyer