GCash makes holiday shopping safer with the help of government partners

It’s that time of the year again–-holiday shopping has never been more exciting, but cybercrimes remain a big risk for consumers.

To help navigate these challenges, GCash is playing a pivotal role this Christmas season. In addition to its robust Insurance products like Send Money Protect (Scam Insurance), GCash has partnered with key government agencies: the Philippine National Police Anti-Cybercrime Group (PNP-ACG), the National Bureau of Investigation (NBI), and the Department of Information and Communications Technology’s Cybercrime Investigation and Coordinating Center (DICT-CICC) to combat online fraud and scams.

To have a secure and hassle-free shopping experience during the holidays, it’s crucial to choose a trusted e-wallet platform. Here are the key qualities to look for:

- Robust security products

When choosing an e-wallet, look for one that’s trusted by many and consistently updates its security products. This means it should be able to keep up with the latest security technology to protect your transactions and personal information. With strong security measures in place, you can confidently manage your finances and make transactions, knowing your funds are protected.

Whether you’re shopping, or sending pamasko, GCash adds an extra layer of protection on top of current security features. It offers Send Money Protect (Scam Insurance), a personal cyber insurance product that insures your GCash Express Send money transfers to another GCash Account for up to PHP 15,000.00 in total, should you become a victim of scammers who trick you into sharing personal information, take over your online bank accounts, or make you pay for something that never arrives.

- Proactive against scams

Cyber threats are constantly evolving, and scammers are always coming up with new tactics. It’s no longer enough for an e-wallet to simply have security features—it needs to be proactive in preventing scams.

GCash is committed to preventing scams before they happen. The platform is equipped with advanced tools and features to deter suspicious activity, such as Account Secure which safeguards against unauthorized access to your GCash Account from another device. GCash also partners with trusted financial institutions and government agencies, staying ahead of emerging scam tactics, particularly during high-risk periods like the holiday season.

- Relentlessly combatting fraud

In today’s digital landscape, it’s essential to trust an e-wallet that is cooperative in the fight against fraud. A trusted e-wallet must cooperate with authorities and other partners to detect and prevent fraudulent activities. Knowing that your e-wallet works closely with trusted institutions provides peace of mind that your funds and personal information are continuously protected.

GCash fortifies its internal measures by working hand-in-hand with government agencies to combat fraud. In partnership with PNP-ACG, NBI, and DICT-CICC, GCash plays an active role in tracking and prosecuting fraudsters. This cooperation helps authorities investigate and address scams swiftly, giving users an added layer of security.

- GCash works closely with the Philippine National Police Anti-Cybercrime Group (PNP-ACG) on operations aimed at apprehending cybercriminals through entrapment efforts.

Atty. Maricor Alvarez-Adriano, GCash Chief Legal Officer, Atty Gilbert Escoto, GXI Chief Legal Officer, Gilda C. Maquilan, GCash VP for Corporate Communications and Public Affairs together with PNP ACG Director PBGen. Francis Ronnie Cariaga, PNP-ACG and public affairs and legal teams

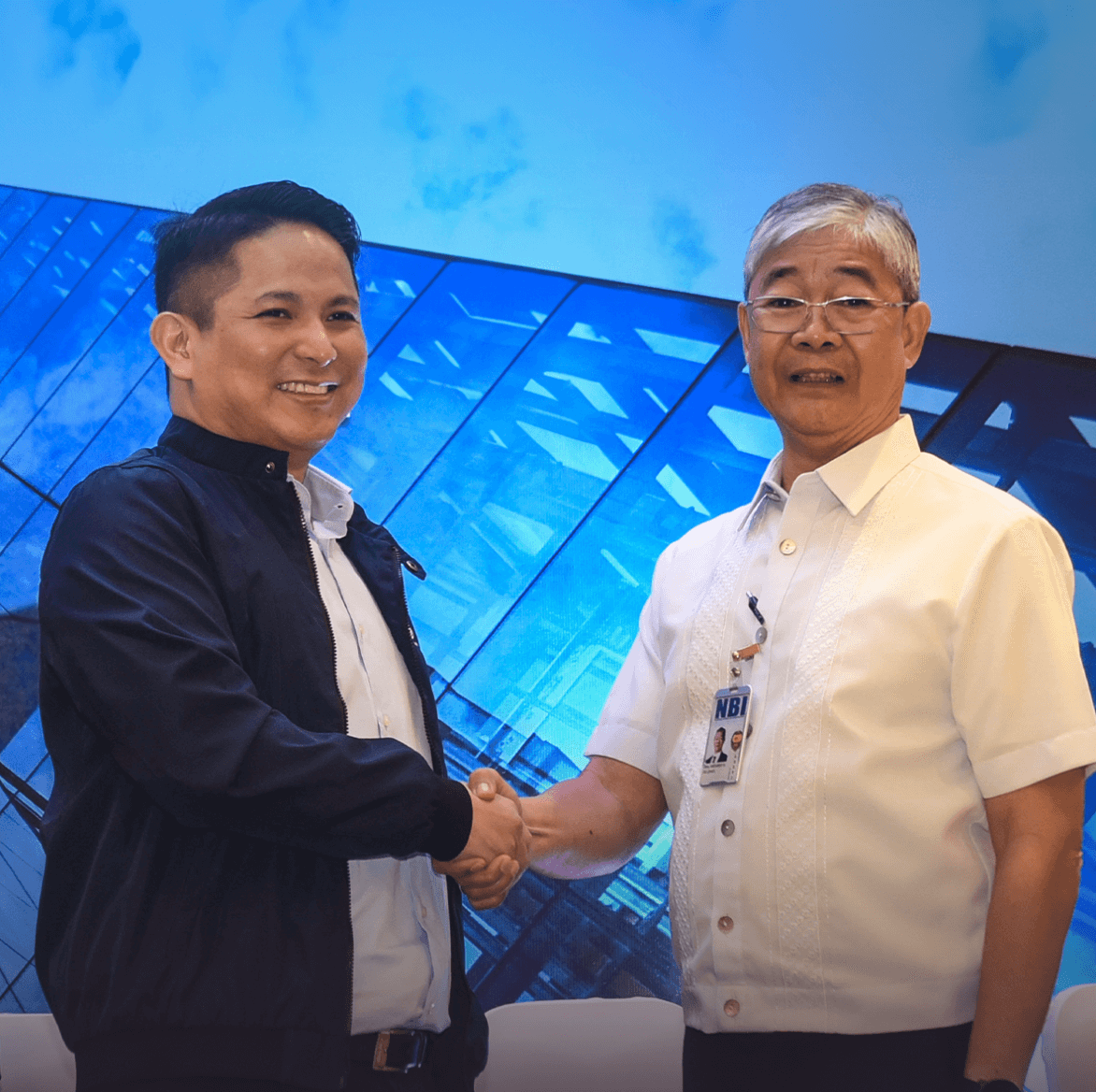

- In January 2024, GCash strengthened its security efforts by formalizing a data-sharing agreement with the National Bureau of Investigation (NBI). This partnership enables GCash to share details of suspicious accounts and transactions with the NBI. With the NBI’s approval, GCash can also halt transactions involving potentially fraudulent users, helping to prevent further risks.

Ren-Ren Reyes, President and CEO of GCash Mobile wallet operator G-Xchange, Inc. and NBI Director Medardo de Lemos

- In February 2024, GCash teamed up with the Department of Information and Communications Technology’s Cybercrime Investigation and Coordinating Center (DICT-CICC) through a Memorandum of Agreement to create a “rapid incident response” system for tackling financial fraud. This collaboration ensures that when CICC identifies new scam tactics, GCash is immediately alerted, allowing the platform to take swift action and protect users from emerging threats.

Usec. Paul Joseph Mercado of DICT; Pebbles Sy, GCash Chief Technology and Operations Officer; Usec. Alexander Ramos, Executive Director of CICC and Asec. Renato Paraiso during the DICT Cybersphere PH Forum

By combining the latest cybersecurity technology, proactive security measures, and strong cooperation with government agencies, GCash helps keep your holiday shopping—and your online transactions—safe and hassle-free. With GCash, you can shop with confidence, knowing that your e-wallet is actively working to protect you from scams and fraud.

ADVT.

This article is brought to you by GCash.