GCash extends assistance to users affected by typhoon Carina

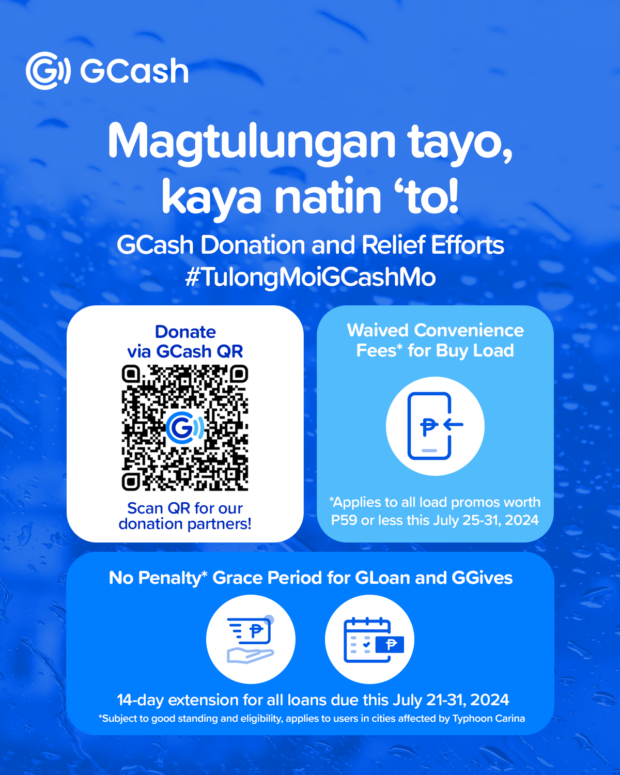

In response to recent challenges brought by super typhoon Carina (international name Gaemi), GCash, through its credit arm Fuse Lending, has announced a two-week payment grace period to borrowers of GLoan and GGives in calamity-hit areas.

“Understanding the importance of having extra money during these challenging times, GCash is offering a grace period to customers whose due dates fall between July 21 and 31, 2024,” said Tony Isidro, president and CEO of Fuse Lending.

This initiative allows customers in some areas of regions III, IV-A, and the National Capital Region affected by Typhoon Carina to postpone their loan payments to August without incurring any penalty charges.

Buy load fees waived

GCash is also waiving the fees for users availing of buy load promos worth P59 and below starting 12 noon of July 25 to July 31.

This would help ease the expenses of customers affected by the severe rains and flood – allowing them to stay connected with their loved ones, updated on news, and continue their livelihood like working from home with ease.

Ensuring GCash Pero Outlets can provide affordable services

To help sari-sari stores in areas affected by super typhoon Carina continue to provide services to their communities, the 0.5% cash-in fee for GCash Pera Outlets is also waived.

This would allow them to fund their wallets without any additional cost and allow them to provide much-needed services like buy load, pay bills, as well as cash-in and cash-out.

#TulongMoiGCashMo: making donations accessible for everyone

To mobilize the spirit of bayanihan amid the onslaught of the heavy rains and flood, GCash is also supporting various organizations by helping them raise funds to mount relief operations for communities hit by the severe weather.

“We are deeply concerned for areas affected by Typhoon Carina,” said Ren-Ren Reyes president and CEO of GCash mobile wallet operators G-Xchange, Inc. “Our priority now is to ensure concerned organizations can quickly mobilize aid, tapping into the reach and impact of GCash.”

GCash users can contribute to various reputable non-governmental organizations which mount rescue, relief, and recovery operations. These NGOs include:

Ayala Foundation

ABS-CBN Foundation

GMA Kapuso Foundation

UNICEF

Philippine Red Cross

Caritas Manila

Save the Children

Users can opt to send funds directly to the NGOs by searching for them in the “Pay Bills” feature under the “Others” category, or scan the official GCash QR Code of the organizations. Transactions fees for these donations are waived.

Beware of scammers posing as donation drives

Users are encouraged to donate only through official payment channels such as the GCash app, and transact only with trusted organizations to avoid donating to dubious organizations. Customers are advised to never share their MPIN or OTP to anyone.

For personal donation drives, GCash urges the public to conduct thorough background checks on individuals and groups before contributing.

Filipinos can download the GCash app for free on Google Play or App Store. For more information on how you can help, visit the official Facebook page of GCash, https://www.facebook.com/gcashofficial.