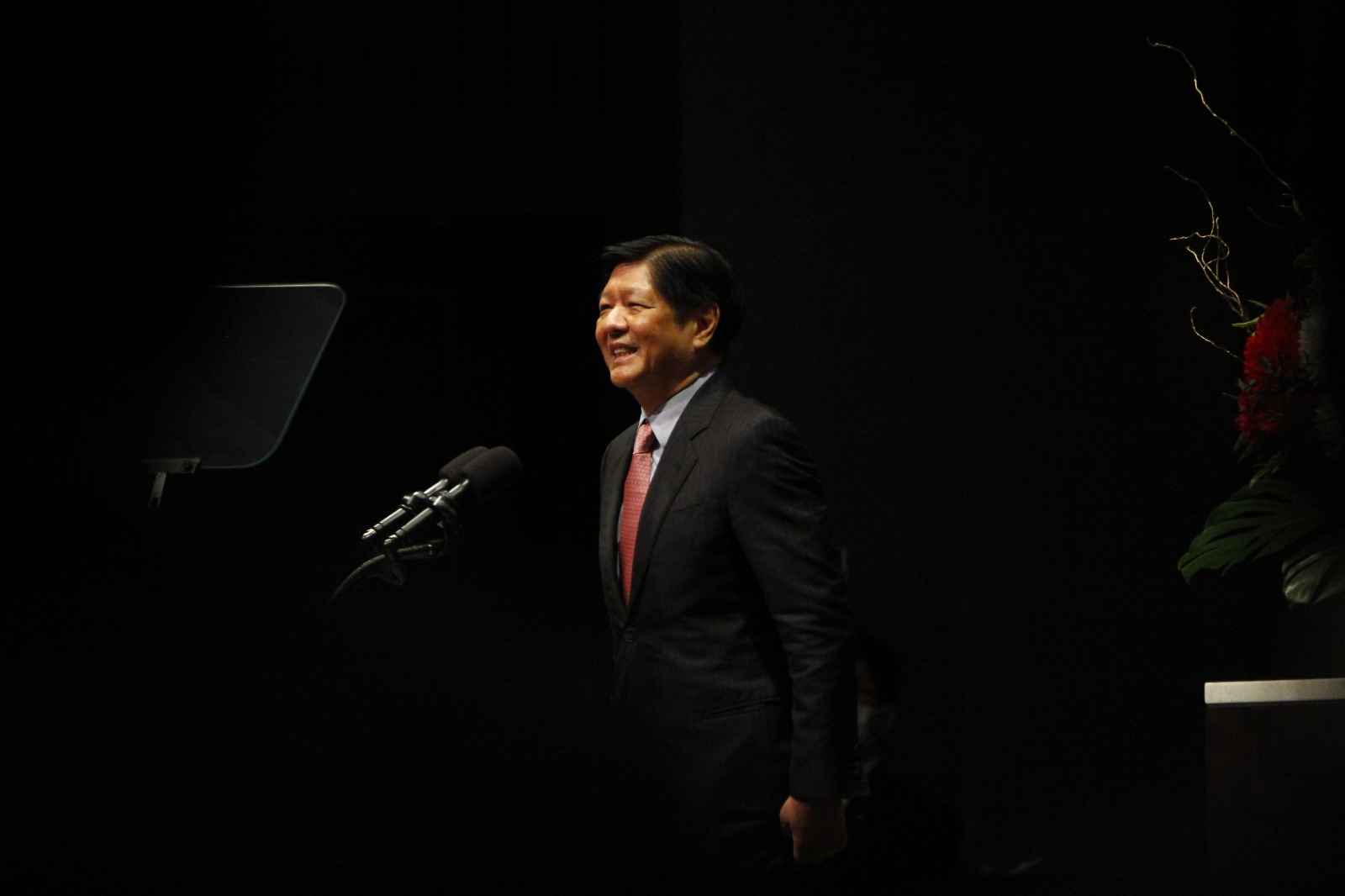

President Ferdinand Marcos Jr. at the Philippine Business Opportunities Forum held in Palace Hotel in Tokyo, Japan, on Friday, February 10, 2023. INQUIRER.net/Gabriel Pabico Lalu

TOKYO, Japan — Three private Japanese corporations have so far committed to investing in the Philippines’ proposed sovereign wealth fund, or the so-called Maharlika Investment Fund (MIF).

President Ferdinand Marcos Jr. disclosed this on Sunday, February 12, during an interview with reporters aboard the plane back to Manila from his five-day official visit to Tokyo for the Philippine Business Opportunities Forum.

But he did not reveal the names of the companies who want to put their money into the MIF out of respect for the firms.

“Some of the private corporations, we mentioned it. We have some commitments but I don’t think it’s appropriate for me to name who they are,” Marcos told reporters.

“But they have – there were already three commitments, substantial amount that they are willing to invest in the fund. So we can begin there,” he added.

Marcos also confirmed the earlier statement of his cousin, House of Representatives Speaker Ferdinand Martin Romualdez, that a Japanese government official expressed interest in the MIF.

“Iba-iba. Mayroon mga government pero mayroon ding private (It’s diverse. There are government players and there are private ones, too),” he added.

Last Friday, Romualdez said in an interview with members of the Philippine press that a high-ranking Japanese financial executive was curious about the MIF. This supposedly happened during the dinner hosted by Japan’s Mitsui & Co. and Metro Pacific Investments Corporation (MPIC) last Wednesday, February 8.

Romualdez also claimed that some MIF stakeholders believe that the potential of the Philippines’ sovereign wealth fund is higher than Indonesia’s own sovereign wealth fund, the Indonesia Investment Authority (INA).

READ: Romualdez says high-ranking Japan exec strongly interested in Maharlika fund

“It was during our conversation that he expressed strong interest (in the Maharlika Investment Fund) and in the possibility of investment in the proposed sovereign wealth fund, particularly for the power sector,” Romualdez had said.

“So that’s very good, that we’re getting support (for the Maharlika Investment Fund),” he added.

Romualdez was part of Marcos’ entourage in the Japan trip which, according to the President, resulted in more than $13 billion in contributions and investment pledges for the Philippines.

Also previously, the House Speaker expressed optimism that the proposed establishment of MIF would be approved by Congress after Easter Sunday, which falls on April 9 this year.

On December 15, 2022, the lower chamber passed House Bill (HB) No. 6608 — the latest version of the MIF — on the third and final reading. It was approved by the House on the same day it was passed on second reading as President Marcos certified the bill as urgent.

It could be remembered that the original version of the bill, HB No. 6398, attracted controversy as it proposed to source P125 billion from the Government Service Insurance System (GSIS) and P50 billion from the Social Security System (SSS) as seed money for the MIF.

This raised fears that member-pensioners of GSIS and SSS may lose their funds if investments made through the MIF fail.

Eventually, money from the GSIS and SSS — including funds from the national budget — were removed from the list of startup money sources for the MIF. The final version of the bill which was approved by the House before the session break last December also explicitly stated that the MIF would never source funds from GSIS and SSS.

READ: Proposed Maharlika Fund would no longer include SSS, GSIS funds — Quimbo