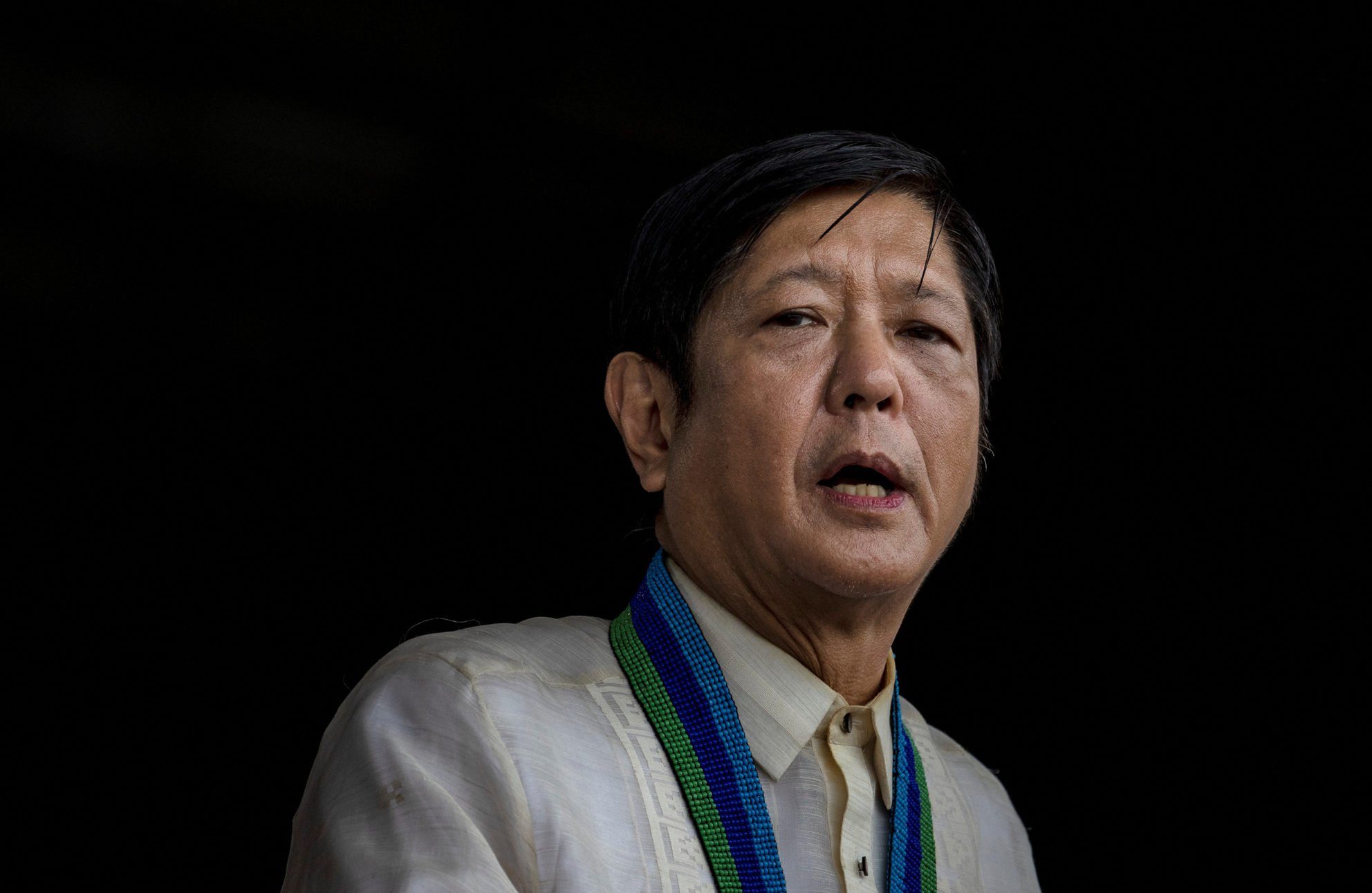

FILE PHOTO: Philippine President Ferdinand Marcos Jr. speaks during a change of command ceremony at Camp Aguinaldo, Quezon City, Philippines, August 8, 2022. Ezra Acayan/Pool via REUTERS

MANILA, Philippines — President Ferdinand Marcos Jr. will introduce the proposed Maharlika Wealth fund on the world stage during the 2023 World Economic Forum (WEF), the Department of Foreign Affairs (DFA) said Thursday.

DFA Undersecretary Carlos Sorreta said it was the President who broached the idea of tackling the controversial sovereign fund at the WEF, which will be held in Davos, Switzerland this month.

“At the briefing this morning, the President said that we have developed excellent fundamentals, there’s much that we can offer to investors and he said ‘you know let’s talk about the sovereign wealth fund that’s being set up’,” he said in a Palace briefing.

Sorreta said the WEF will be a “great venue” to “soft launch” the Maharlika Wealth fund, which is yet to secure approval from Congress.

“The WEF is a great venue to do a sort of soft launch for our sovereign wealth fund, given the prominence of the forum itself and global and business leaders will be there,” he said.

The DFA official said that while Congress is still fine-tuning the proposed law, the President already has a very good grasp of the bill’s “broad strokes” and “what he wants to achieve in whatever form the sovereign wealth fund finally takes.”

“What’s very important is it’s an investment in the future and there’s great confidence the President has and the capability of the Filipino entrepreneurs and local investors even,” Sorreta said.

For her part, Malacañang press briefer Daphne Oseña-Paez said the WEF is an opportunity for the Philippines to let the world know what the Philippines is doing “in terms of being ready and attractive for investments.”

Under the proposed Maharlika Wealth fund law, the government will get money from the Land Bank of the Philippines and Development Bank of the Philippines, and from dividends of the Bangko Sentral ng Pilipinas to raise its P110 billion venture capital.

The first version of the bill, which proposed that seed money will be sourced from Government Service Insurance System and the Social Security System, earned widespread objection – prompting lawmakers to revise and remove the state-owned pension funds from the list of budget sources for the Maharlika Wealth fund.

RELATED STORIES

Maharlika wealth fund: Misguided, unnecessary, costly — Risa Hontiveros

Maharlika fund: Will the pros outweigh the cons?