Older Asian Americans rely on U.S. Social Security benefits

WASHINGTON, D.C. – Social Security benefits are indispensable to the security of retired Asian Americans and Pacific Islanders (AAPIs), according to AARP Public Policy Institute’s new fact sheet.

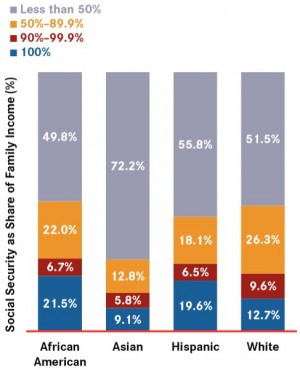

Older Minorities Depend on Social Security to Provide a Significant Share of Family Income (Source: AARP Public Policy Institute’s tabulations of US Census Bureau, “Current Population Survey,” March 2014).

Sixty-five percent of AAPIs age 65 and older receive Social Security benefits, including 28 percent who rely on it as their primary source of family income. Nine percent of older AAPIs rely on Social Security as their only source of family income.

“Social Security: Who’s Counting on It?” provides insight into how Social Security benefits all Americans. Last year, about 59 million people received Social Security, a federal program designed to protect individuals who can no longer work and their families from loss of income due to retirement, disability, or death.

“Following the 80th anniversary of Social Security last month, it is a lifeline for many AAPIs that helps keep them and their families out of poverty,” said Daphne Kwok, AARP Vice President of Multicultural Leadership, Asian American and Pacific Islander Audience. “AARP works to strengthen Social Security because the vast majority of Americans of all ages believe it is important to provide financial security for everyone.”

As recent immigrants, AAPIs have lower median Social Security incomes according to an AARP report issued last year. Therefore they are less likely than African Americans, Hispanics and whites to depend on Social Security for 50 percent or more of their family income.

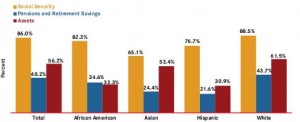

Percentage of Americans Ages 65 or over with Any Family Income from Pensions, Assets, or Social Security, by Race and Ethnicity (Source: AARP Public Policy Institute’s tabulations of US Census Bureau, “Current Population Survey,” March 2014).

Older minorities are less likely than whites to have family income other than Social Security. A little more than half (53.4 percent) of AAPIs age 65 and older own have income from assets, but only a quarter (24.4 percent) have income from pensions and retirement savings.

Other key findings:

Article continues after this advertisement- Social Security income kept roughly 33 percent of older Americans, about 14.7 million people, out of poverty. The poor (income below poverty line) and the near-poor (income between 100 and 150 percent of the poverty line) rely on Social Security for a significant share of their family income.

- Social Security benefits are particularly important for women because, on average, women live longer and earn less than men do, so they are more dependent than men are on Social Security’s progressive benefit and inflation-adjusted, lifetime income.

- Social Security is currently fully funded with $2.8 trillion in reserves, but in 2020 will begin to be drawn down these reserves in order to continue paying full benefits. At this rate, Social Security reserves will be depleted in 2034, less than 20 years from now.

Visit www.aarp.org/ppi to read AARP Public Policy Institute’s fact sheet and find more information about Social Security. Visit www.aarp.org/aapi to read AARP’s report Are Asian American and Pacific Islanders Financially Secure?

Like us on Facebook